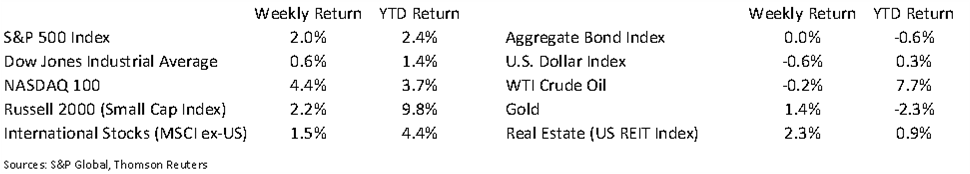

The stock market rebounded last week. For the week, the Dow Jones Industrial Average was +0.6%, the S&P 500 Index was +2.0%, and the NASDAQ 100 Index was +4.4%.

The flurry of fourth quarter earnings reports continue this week with 120 companies in the S&P 500 Index scheduled to report earnings. Of the 66 companies in the Index that have reported quarter-to-date, 87.9% have reported earnings above consensus. Fourth quarter 2020 earnings are currently expected to decline 5.7% year-over-year on a revenue decline of 0.8%. Full-year 2020 earnings are expected to decline 14.1% year-over-year and full-year 2021 earnings are expected to rise 23.7% year-over-year.

Initial unemployment claims during the week of January 16th declined to 900,000 versus 926,000 the previous week. Continuing claims for the week of January 9th were 5.054 million versus 5.181 million the week prior. Industries such as entertainment, recreation, lodging, and food service remain the weakest employment areas.

The Federal Reserve’s Federal Open Market Committee (FOMC) meets this week for their initial meeting of 2021. We expect them to keep interest rate policy unchanged.

In our Dissecting Headlines section, we look at the Federal Open Market Committee.

Financial Market Update

Dissecting Headlines: FOMC

The Federal Open Market Committee, or “FOMC”, is a branch of the Federal Reserve Board that meets several times a year to make decisions on monetary policy. The Committee is comprised of the seven-member Board of Governors and five Federal Reserve Bank presidents.

The FOMC meets eight times a year to discuss the U.S. economy and make decisions to keep the economy on track. The goal, as mandated by Congress, is to promote maximum employment, stable prices, and moderate long-term interest rates.

At the conclusion of each meeting the FOMC chairman typically holds a press conference to discuss any decisions the Committee has made. This can sometimes be a decision to raise or lower short-term interest rates. Even when a specific decision is not made, many market watchers will dissect the language of the policy statement to gain an understanding of what the FOMC may do in the future.

__________________________________________________________

Want a printable version of this report? Click here: NovaPoint January 25, 2020

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.