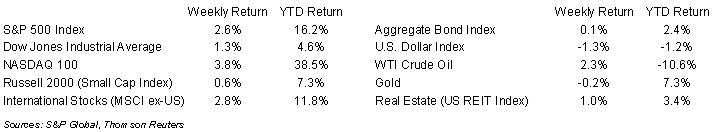

The rally in equities continued last week with the S&P 500 Index +2.6%, the Dow was +1.3%, and the NASDAQ was +3.8%. The 10-year U.S. Treasury note yield increased to 3.769% at Friday’s close versus 3.745% the previous week.

The Federal Open Market Committee (FOMC) left the Fed funds rate flat at the 5.00% to 5.25% range but increased its outlook for the terminal Fed funds rate by 0.50% to a 5.50% to 5.75% range. The increase in the forecasted Fed funds rate is rooted in the FOMC’s updated Summary of Economic Conditions that show a modestly growing economy with Gross Domestic Product for 2023 expected to grow 1.0% versus the Committee’s previous forecast of 0.4%. The Committee also expects the labor market to remain reasonably strong with its forecast for the Unemployment Rate to be 4.1% versus 4.5% previously. Lastly, the FOMC expects core inflation, as measured by the core Personal Consumption Expenditures (PCE) Price Index to be 3.9% versus 3.6% previously. The increase in the Fed funds target rate leaves headroom for additional short-term interest rate increases at the FOMC’s July and September meetings. Fed Chairman Jerome Powell stressed the FOMC would be data dependent on its decision making for future interest rate policy.

In our Dissecting Headlines section, we look at the forecast for second quarter earnings for the S&P 500 Index companies.

Financial Market Update

Dissecting Headlines: Second Quarter Earnings

With the end of June in sight, we look ahead to the second quarter earnings reporting season for companies in the S&P 500 Index. The Index ended the first quarter with year-over-year growth in earnings of 0.03% on revenue growth of 3.6%. The best earnings growth came in the Consumer Discretionary sector at 56.1% year-over-year growth and the poorest performer was the Materials sector with a 22.2% year-over-year earnings decline.

For the second quarter, the current consensus forecast is for a 5.6% year-over-year earnings decline for the S&P 500 Index on a revenue decline of 0.6%. Growth is expected in six sectors: Consumer Discretionary (+26.0% year-over-year earnings growth), Financials (+9.7%), Communications Services (+9.3%), Industrials (+6.2%), Utilities (+2.8%) and Consumer Staples (+1.8%). Earnings are forecast to decline in five sectors: Energy (-44.4%), Materials (-27.4%), Healthcare (-15.7%), Real Estate (-4.9%) and Information Technology (-3.3%).

Expectations for full year 2023 earnings are an increase of 1.4% on revenue growth of 1.8%.

Changes in these expectations over the course of the second quarter reporting period are likely to dictate the movement of the market as a whole and individual stocks. Investors should be interested to see how companies have navigated the changes in economic conditions following the ten consecutive FOMC interest rate increases that paused last week.

________________________________________

Want a printable version of this report? Click here: NovaPoint Weekly June 19, 2023

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.