Stocks leveled off last week after a multi-week advance. For the week, the S&P 500 Index was flat, the Dow was -2.3%, and the NASDAQ was +0.4%. Within the S&P 500 Index, the Technology and Communication Services sectors were the only two with a weekly advance. The Energy, Real Estate, and Financial sectors were …

NovaPoint Supports Veterans Service Organizations

NovaPoint would like to show our respect for those who have made the ultimate sacrifice in defense of our freedom. In their honor, we are making donations today to two Veterans Service Organizations: the Children of Fallen Patriots Foundation and the Special Operations Medical Association. Children of Fallen Patriots provides college scholarships and educational …

Continue reading “NovaPoint Supports Veterans Service Organizations”

Hello Summer

Stocks advanced to new highs last week. For the week, the S&P 500 Index was +1.6%, the Dow was +1.3%, and the NASDAQ was +2.2%. Within the S&P 500 Index, the Technology, Real Estate, and Health Care sectors led the advance, while the Industrial, Consumer Discretionary, and Materials sectors lagged. The 10-year U.S. Treasury …

Bouncing Back

Stocks advanced in a week with little major data to sway sentiment. For the week, the S&P 500 Index was +1.9%, the Dow was +2.2%, and the NASDAQ was +1.5%. Within the S&P 500 Index, the Utility, Financial, and Materials sectors led the advance, while the Consumer Discretionary, Energy, and Technology sectors lagged. The …

Cool Jobs

A steady Federal Reserve and a moderating labor market helped stocks rise for a second consecutive week. For the week, the S&P 500 Index was +0.6%, the Dow was +1.1%, and the NASDAQ was +1.0%. Within the S&P 500 Index, the Utility, Real Estate, and Technology sectors led the advance, while the Energy, Financials, …

Fundamental Victory

Stocks snapped their three-week losing streak on several strong earnings reports. For the week, the S&P 500 Index was +2.7%, the Dow was +0.7%, and the NASDAQ was +4.0%. Within the S&P 500 Index, the Technology, Consumer Discretionary, and Industrial sectors led the advance, while the Materials, Health Care, and Communication Services sectors trailed. …

April Showers

Stocks continued their decline for the third consecutive week. For the week, the S&P 500 Index was -3.0%, the Dow was flat, and the NASDAQ was -5.4%. Within the S&P 500 Index, the Utility, Consumer Staples, and Financial sectors had gains for the week, while the Technology, Consumer Discretionary, and Real Estate sectors had …

Pricey Persistence

Stocks declined for a second consecutive week on concerns inflation is not receding. For the week, the S&P 500 Index was -1.5%, the Dow was -2.4%, and the NASDAQ was -0.6%. All eleven S&P 500 sectors declined with the Technology, Consumer Discretionary, and Consumer Staples sectors declining the least, and the Financials, Materials, and …

NovaPoint 2nd Quarter 2024 Newsletter

We invite you to review our Quarterly Newsletter which includes investment market commentary, tax, and business retirement plan insights. There is also an awesome recipe for pea and bacon risotto! Link to the Quarterly Newsletter here: Newsletter To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us …

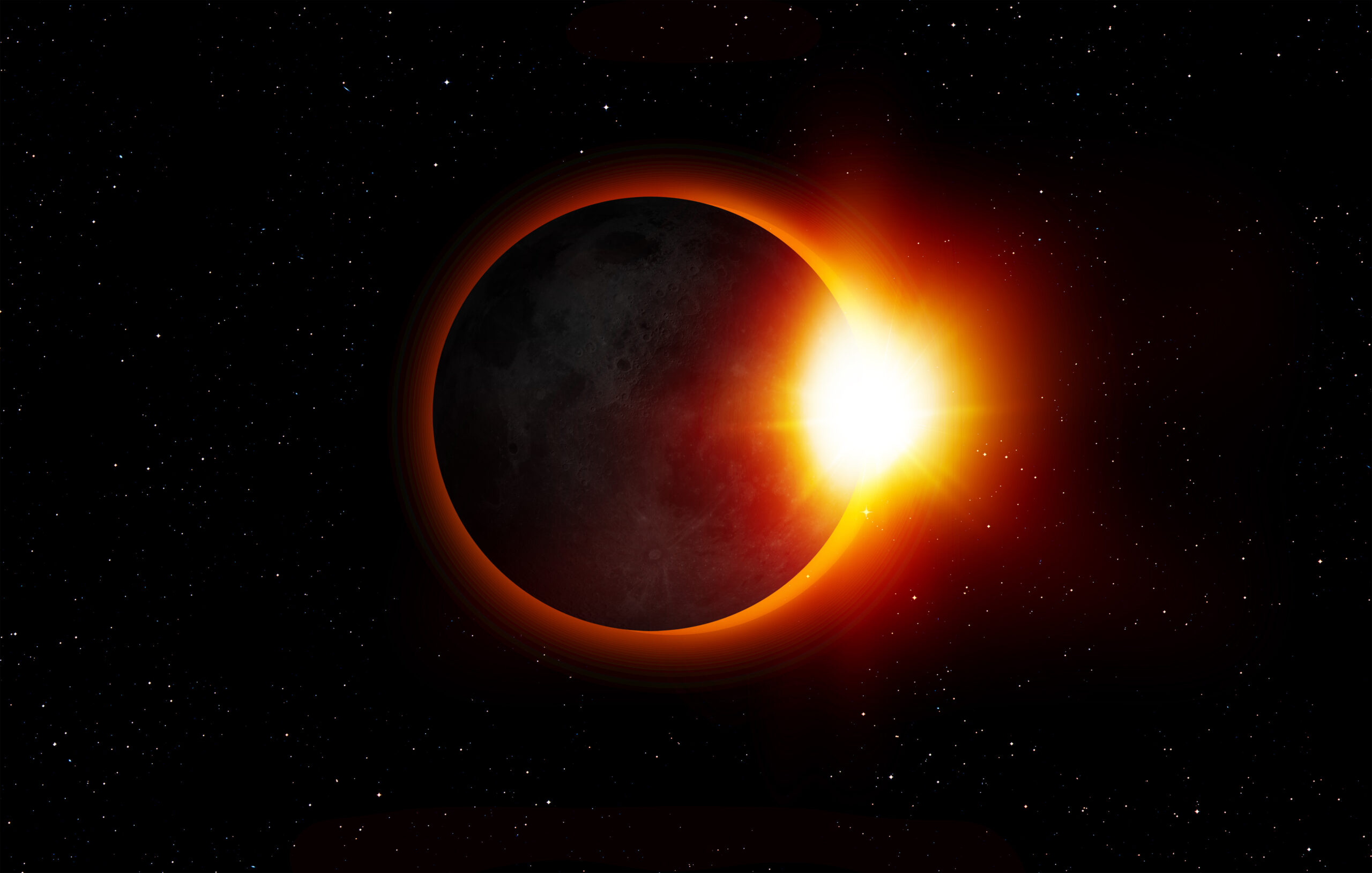

Eclipsed

Stocks were eclipsed by strong economic data to start the second quarter. For the week, the S&P 500 Index was -0.9%, the Dow was -2.2%, and the NASDAQ was -0.8%. The best performing sectors in the S&P 500 Index were the Energy, Communication Services, and Materials sectors, while the Health Care, Real Estate, and …