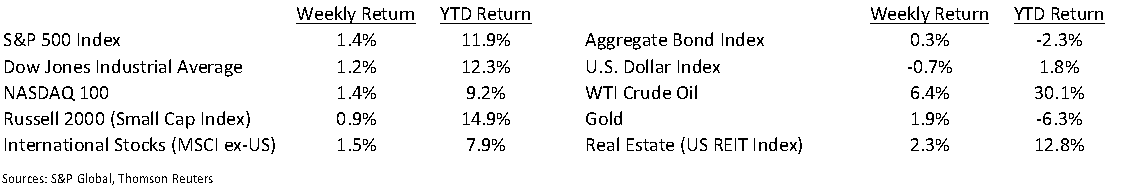

The equity markets responded positively to the first week of first quarter earnings. Of the 44 companies in the S&P 500 Index that have reported earnings to date for the first quarter, 84.1% have reported earnings above analyst estimates. The Dow Jones Industrial Average closed the week +1.2%, the S&P 500 Index was +1.4% and the NASDAQ 100 Index was +1.4%. Stocks were also aided by a decline in the U.S. 10-year Treasury yield which fell to 1.573% at Friday’s close versus 1.666% the previous week.

This week 79 companies in the S&P 500 Index are scheduled to report earnings. First quarter earnings are expected to grow 30.9% year-over-year, an increase from last week’s expectation of 25.0% growth. Full-year 2021 earnings are expected to grow 27.9% year-over-year versus expectations of 26.5% growth last week.

Initial unemployment claims for the week of April 10th decreased to 576,000 versus the previous week at 769,000. Hiring is on the rise in previously hard hit cities such as Las Vegas as domestic travel continues to increase. Continuing claims for April 3rd were 3.731 million versus 3.727 million the week prior.

In our Dissecting Headlines section, we look at the impact energy prices have had on inflation expectations.

Financial Market Update

Dissecting Headlines: Energy and Inflation

The topic of inflation keeps circling around in questions from clients and in the financial media. If we look at the March Producer Price Index (a gauge for wholesale inflation) and Consumer Price Index (a gauge for retail inflation) data, we see that a large part of the increase has been attributable to energy prices. Energy prices increased 5.9% month-over-month in the March PPI and increased 5.0% in the CPI.

As a point of reference, oil was $61 per barrel at the start of 2020 and is $63 per barrel today. But as we start to measure price changes from the early days of the pandemic, the math looks more dramatic. Oil prices are 245% higher year-over-year after falling below $17 per barrel in April 2020 in the depth of the COVID. At that point, the rapid decline in demand was driving storage well above historical averages. Excess crude inventories above historical averages peaked in July 2020 at 249 million barrels and as of February 2021 had declined to 57 million barrels. This decline in excess supply coupled with a return of demand has increased prices.

The excess supply is not quite back to historical averages, but several areas of the world, such as Europe, India and Brazil, are also not back up to economic pre-pandemic activity levels. The Energy Information Agency is predicting global oil consumption should average 97.7 million barrels per day in 2021 versus 92.2 million in 2020, but still short of 2019’s average of 101.2 million. While a supply response is not likely to immediately flood the global economy with more crude oil, a gradual increase in oil production should help normalize the energy component of inflation.

__________________________________________________________

Want a printable version of this report? Click here: NovaPoint April 19th, 2021

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.