On Wednesday, the Federal Open Market Committee (FOMC) will make a decision on its interest rate target. The current market probabilities are for a reduction of 0.25% which would bring the target range for the Fed Funds Rate to 2.00% to 2.25%. We can attribute most of the stock market tailwind over the past month to the view that the FOMC will reduce interest rates to balance the risk to economic expansion caused by global trade and tariff issues.

The Advance GDP report for the 2nd quarter showed 2.1% growth in the U.S. economy. This is a decrease from the 3.1% rate of growth seen in the 1st quarter and supports investors view that a reduction in interest rates is warranted. Fed Chairman Jerome Powell stated in early June that the Fed will act appropriately to sustain the current economic expansion.

A generally positive corporate earnings season has also contributed to pushing the S&P 500 Index to all-time highs. Two hundred eighteen companies in the S&P 500 have reported quarter-to-date with 75% reporting earnings above expectations, 18% below expectations, and 7% in-line. Earnings reports were mixed last week. The current consensus expectations for the S&P 500 Index earnings growth for the quarter moderated to +0.5% from +1.0% the week prior, but is higher than the –0.4% expectation at the start of the earnings reporting season. The expectation for revenue growth increased slightly week-to-week from +3.4% to +3.6%.

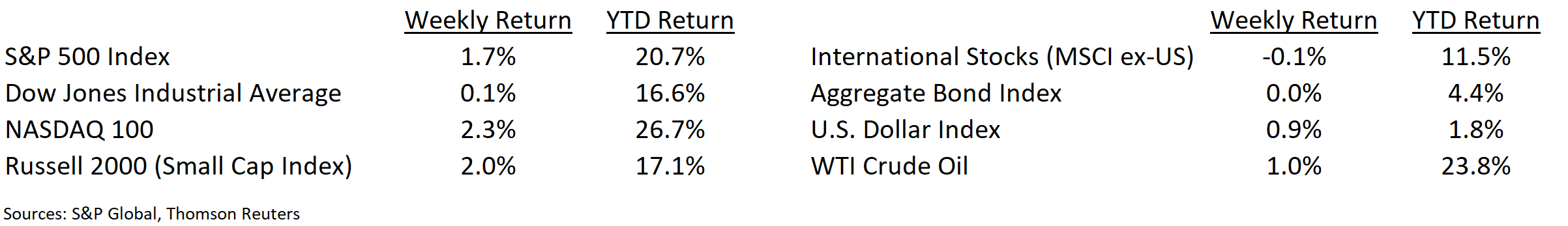

Financial Market Update

Dissecting Headlines: Fed Funds

At the FOMC meeting this week, the Fed is widely expected to lower its Fed Funds target rate by 0.25% to a range of 2.00% to 2.25%. What are Fed Funds and how does this impact the economy?

The term Fed Funds is short for Federal Funds. These are the excess reserves that commercial banks and other financial institutions have on deposit at the Federal Reserve’s regional banks. These excess funds are lent to other market participants with insufficient cash on hand to meet their reserve or lending needs. The FOMC sets the rates on these loans, the Fed Funds Rate, which serves as a benchmark for overnight loans between financial institutions.

When the FOMC adjusts this interest rate target it makes the cost of borrowing money more or less expensive. When money is less expensive to borrow it generally provides stimulus to the economy. This is why we see the expectation of a reduction in the Fed Funds Rate target be a stimulus for the stock market as investors believe the lower interest rates should boost economic growth.

___________________________________________________________

Want a printable version of this report? Click here: NovaPoint July 29, 2019

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.