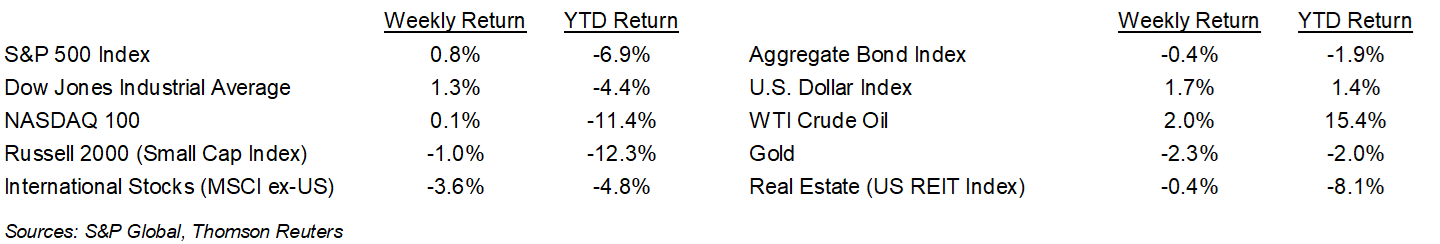

Buoyed by several strong corporate earnings reports, the major U.S. equity indices all closed the week higher for the first time this year. The S&P 500 Index ended the week +0.8%, the Dow was +1.3%, and the NASDAQ was +0.1%. The U.S. 10-year Treasury bond yield increased to 1.778% at Friday’s close versus 1.771% the previous week.

For the fourth quarter of 2021, 168 companies in the S&P 500 Index have reported earnings results and 77.4% have reported earnings above analyst estimates. This compares to a long-term average of 65.9% and prior four quarter average of 83.9%. The current consensus forecast is for fourth quarter earnings to grow 25.2% on 13.4% revenue growth versus an expectation of 22.4% earnings growth on 12.1% revenue growth at the start of the earnings season. During the coming week,108 companies in the S&P 500 Index are scheduled to report earnings.

The Federal Reserve held its January meeting last week. It announced that it would soon be appropriate to start raising short-term interest rates. It is widely anticipated that the Federal Reserve will increase the Fed funds target rate by 0.25% following its meeting on March 16th. The tapering of monthly bond purchases should be substantially complete by that time as well.

In our Dissecting Headlines section, we look at the frequency of market corrections.

Financial Market Update

Dissecting Headlines: Corrections and Recoveries

Whenever stocks decline by 10% it is deemed a market correction. While these can be unexpected and result in swift downturns, they are not rare. Over the past 75 years, there have been eighty-four declines in the S&P 500 Index between 5% and 10%, twenty-nine declines between 10% and 20%, nine declines between 20% and 40%, and three declines greater than 40%.

The recoveries from these downturns tend to be proportionate to the magnitude of the declines. The average time to recover from a 5% to 10% decline is one month. For a 10% to 20% decline, the recoveries have averaged four months. For a 20% to 40% decline, the recoveries have averaged 14 months, and for the few severe declines over 40% the recovery time has averaged 58 months.

Most major declines are associated with severe economic or geopolitical events, whereas the shallower corrections are simply a recurring function of market volatility. Volatility is one of the conditions investors need to accept to benefit from the long-term growth potential of investing in equities. As we presented in our January 3rd report, the S&P 500 Index has a long-term track-record of rising annually 74% of the time with an average return around 10%.

________________________________________

Want a printable version of this report? Click here: NovaPoint January 31, 2022

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.