The Federal Reserve’s Federal Open Market Committee (“FOMC”) held short-term interest rates steady this week. As mentioned in last week’s Commentary, the Fed’s mandate is to promote maximum employment, stable prices, and moderate long-term interest rates. The Fed’s current inflation target is 2% and inflation is currently below that level. This past Friday’s Employment Report showed that the U.S. unemployment rate is at 3.6%, a 49-year low. This economic environment has the Fed on hold from any significant action.

Quarterly corporate earnings reports continue to have a positive surprise averaging +6.3% above consensus. For the S&P 500, 338 out of 500 companies have reported with 76% beating expectations, 6% matching and 18% below expectations. The combined (reported and estimated) earnings growth for the first quarter now stands at +0.9% versus -2.3% three weeks ago. What was initially expected to be a quarter of negative growth now looks to be shaping up as a positive growth quarter.

We’re past the peak of quarterly earnings but with some significant companies still to report. The Producer Price Index (PPI) and Consumer Price Index (CPI) reports will be released later this week. They are good measures of inflation.

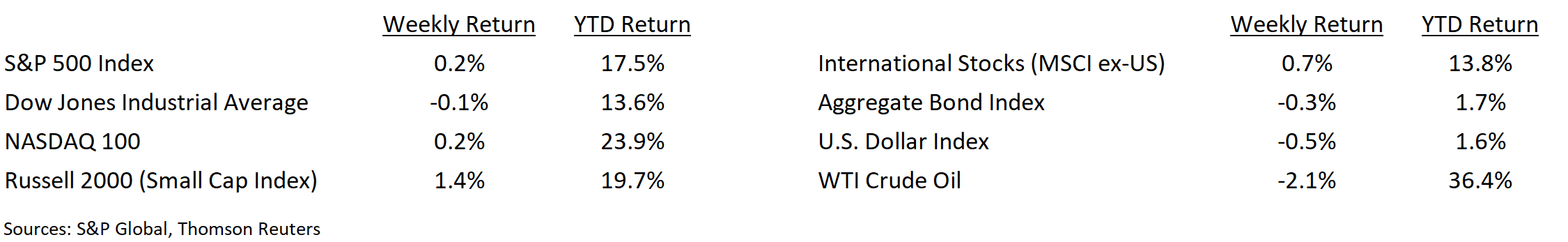

Financial Market Update

Dissecting Headlines: Consumer Price Index

Inflation is the increase in prices for a basket of goods and services in the economy. If the same basket of items costs 2% more this year than last year, then inflation is 2%. This is important because it means an average consumer needs 2% more money to purchase the same goods. This level of inflation that is experienced by consumers can be measured every month in the Consumer Price Index (CPI).

The Consumer Price Index (CPI) measures goods and services in eight categories: Housing, Food, Health Care, Recreation, Apparel, Transportation, Education/Communication, and Other Goods and Services. It is designed to measure prices across a broad basket that would effect most consumers, or what would be considered “retail inflation”.

Two headline numbers are usually reported: CPI and CPI ex Food and Energy. Food and energy prices can be volatile month-to-month and removing these items measures “core inflation”.

The April CPI report will be released on May 10th. The trailing twelve month change in CPI is currently +1.9% and ex Food and Energy it is +2.0%.

___________________________________________________________

Want a printable version of this report? Click here: NovaPoint May 6, 2019

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.