The S&P 500 closed out its best first quarter since 2009. The quarter came in like a lion and went out like a lamb. The giant January rebound (+8.0%) stepped down to more normal returns in February (+3.2%) and March (+1.9%). The quarterly gain almost erased the steep decline from the fourth quarter of 2018.

What lies ahead? U.S.-China trade issues remained unresolved. This uncertainty is impacting economic growth in both countries. Employment remains healthy and mortgage rates have moved back toward 4%. Oil and gasoline prices have increased during the first quarter, turning a consumer tailwind into a consumer headwind for additional discretionary spending.

These uncertainties likely keep the Fed on hold for any additional interest rate increases. The patient, data dependent stance from the Fed should keep a very flat yield curve from any prolonged period of significant inversion. The Fed even has the ability to reduce interest rates if the economy weakens significantly. The conversation has certainly shifted from “How many interest rate increases might there be in 2019?” to “Could the Fed reduce interest rates in 2019?”. Stay tuned.

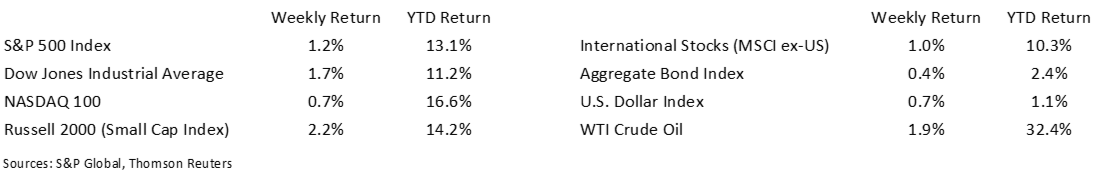

Financial Market Update

Dissecting Headlines: Retail Sales

The Census Bureau publishes a monthly report on U.S. Retail Sales. Data is collected from retailers in most major retail categories, big and small stores, and both traditional and online retailers. The report provides a good snapshot of the state of retail spending overall, and in specific categories.

Volatile categories such as gasoline sales are included and the impact on gasoline prices on other categories can be analyzed. Automobile sales are also included in the report.

Food services (restaurants and bars) are included, but other service-based outlets are not included.

Consumer spending makes up approximately two-thirds of the U.S. economy, so the data provided in the Retail Sales report is a valuable tool to monitoring the health of the consumer.

Current and previous Retail Sales reports can be found on the Census Bureau website: https://www.census.gov/retail/index.html

___________________________________________________________

Want a printable version of this report? Click here: NovaPoint April 1, 2019

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.