A double-shot of positive news lifted major market averages last week. Fed Chairman Jerome Powell reinforced his supportive posture to keep the U.S. economy growing and the White House announced President Trump and President Xi of China would meet during the G20 meeting in Japan at the end of this week. Both announcements supported the market rally that began earlier this month. This positive economic news coupled with rising tensions rising in the Persian Gulf combined to push crude oil up over 9% for the week.

Interest rates continue to decline. Since the beginning of May, the 10-year treasury bond yield has declined from 2.50% to 2.06% at weeks end. This movement at the 10-year maturity has reinforced market speculation that the Federal Open Market Committee would need to lower it’s Federal Funds rate target below the current 2.25% to 2.50% range.

The current economic forces are offsetting each other. A positive outcome in U.S.—China trade talks would likely keep the Fed on hold and push interest rates back up. A negative outcome on trade leaves the door open for the Fed to lower interest rates to maintain growth in the economy. This is a more viable scenario than we were faced with in December when U.S.—China trade was faltering and the Fed looked poised to continued raising rates regardless of external risks. Risks are now much more balanced given a Dovish Fed and the potential for the U.S. to find a path forward on trade with China, the Dragon.

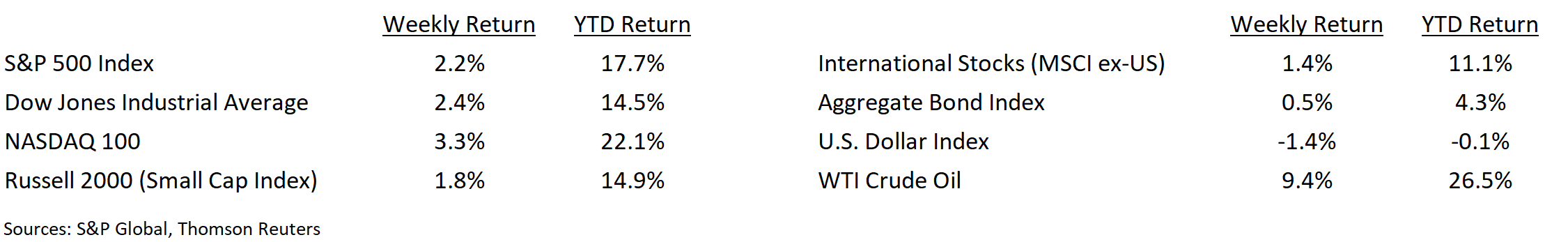

Financial Market Update

Dissecting Headlines: Bank Stress Tests

One outcome of the 2008-2009 financial crisis is the monitoring of “too big to fail” large banks to make sure they are not taking on too much risk. Each year the Federal Reserve conducts a Comprehensive Capital Analysis and Review (CCAR) of all large banks that are important to the health of the U.S. economy.

This past Friday, the Federal Reserve announced the nation’s largest and most complex banks have strong capital levels that would allow them to stay well above their minimum requirements after being tested against a severe hypothetical recession. This “stress test” is meant to know if any banks have the potential to fail during a severe recession like 2008-2009. The banks tested this year represent about 70% of the assets of all banks operating in the U.S. Smaller and less complex banks are tested ever other year.

A second step to the CCAR is to evaluate the capital plans that each bank has presented to the government. Later this week the Federal Reserve will determine if each bank has presented an adequate capital plan, to include dividends and share repurchases. If the plans are approved, we should expect to see many of the major banks make announcements to increase their dividend to share holders.

___________________________________________________________

Want a printable version of this report? Click here: NovaPoint June 24, 2019

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.