The equity markets put together back-to-back winning weeks as the economy and COVID-19 news is less worse than it was potentially forecast to be just a few weeks ago. The curve appears to be flattening on COVID, select parts of the U.S. are set to be opened this month, and most of the early corporate earnings reports and commentary weren’t as bad as potentially feared. While society and the economy are far from back to normal, there is growing sentiment that, in the words of Winton Churchill, “Now is not the end. It is not even the beginning of the end. But it is, perhaps, the end of the beginning”.

We continue to monitor employment as a key metric to gauge the potential economic impact from COVID-19. First-time unemployment claims for the week of April 11th were 5.2 million, a second week of decrease from the 6.6 million on April 4th and the 6.9 million on March 28th. The four-week moving average increased to 5.5 million from 4.3 million as the larger increases from the past three weeks factor into the moving average calculation.

The depressed level of oil prices has been having an impact on domestic drilling activity. The count of active U.S. oil rigs declined 12% last week and have declined 48% over the past twelve months. The combination of lower drilling activity and eventual return of demand for transportation fuels (gasoline, jet fuel, etc.) should bring the market back into balance once economic activity resumes.

Continuing unemployment claims, which we explain in our Dissecting Headlines section, were reported at 12.0 million for the week of April 4th, up from 7.4 million the week of March 28th.

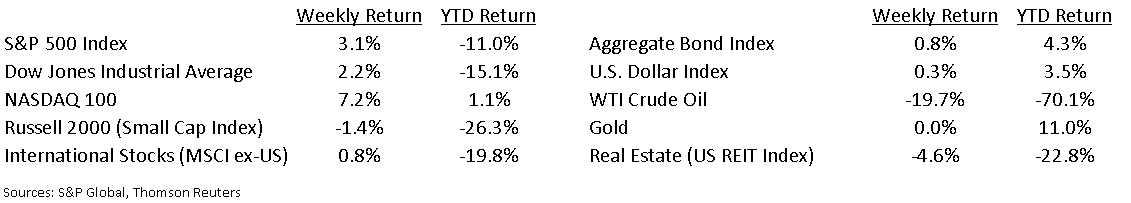

Financial Market Update

Dissecting Headlines: Continuing Unemployment Claims

The weekly headline grabbing announcement in the labor market for the past few weeks has been initial unemployment claims. This measures the number of new workers applying for unemployment. An additional weekly data point in the labor market is continuing unemployment claims. This measures the number of workers currently collecting unemployment payments. Like initial claims, continuing claims are also released by the Department of Labor. Continuing claims are released on a one-week lag, so the most recently reported week for continuing claims was April 4th, while the most recent initial claims data was from April 11th.

With the potential peak in initial claims seen the week of March 28th, monitoring the progress of continuing claims along with the monthly employment report, can help gauge the rate at which individuals are returning to work as the economy recovers from the COVID-19 induced unemployment spike. As mentioned above, continuing unemployment claims were reported at 12.0 million for the week of April 4th, up from 7.4 million the week of March 28th.

Continuing unemployment claims and initial unemployment claims are reported each Thursday morning.

___________________________________________________________

Want a printable version of this report? Click here: NovaPoint April 20, 2020

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.