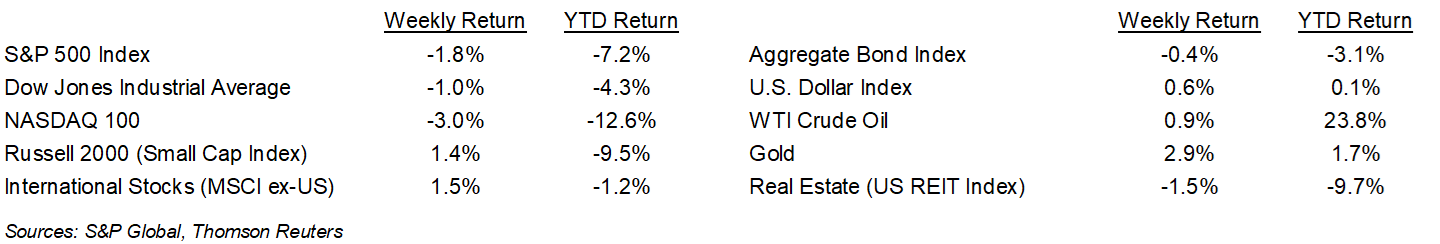

Geopolitical tension over Russia-Ukraine knocked back the equity markets on Friday afternoon. This brought a two-week win streak to an end for the major averages. The S&P 500 Index ended the week – 1.8%, the Dow was -1.0%, and the NASDAQ was -3.0%. The U.S. 10-year Treasury bond yield increased to 1.918% at Friday’s close versus 1.916% the previous week, but its yield briefly eclipsed 2% on Thursday for the first time since 2019.

For the fourth quarter of 2021, 358 companies in the S&P 500 Index have reported earnings results and 78.2% have reported earnings above analyst estimates. This compares to a long-term average of 65.9% and prior four quarter average of 83.9%. The current consensus forecast is for fourth quarter earnings to grow 31.0% on 14.5% revenue growth versus an expectation of 22.4% earnings growth on 12.1% revenue growth at the start of the earnings season. During the coming week, 59 companies in the S&P 500 Index are scheduled to report earnings.

In our Dissecting Headlines section, we look at changes in consumer behavior due to inflation.

Financial Market Update

Dissecting Headlines: Consumer Behavior

The Consumer Price Index (CPI) for January showed year-over-year inflation of 7.5%. This is the highest rate of price increases in several decades. Higher energy prices have been a large part of the increase since last year, and the core CPI, which excludes changes in food and energy prices, was 6.0% higher year-over-year.

While the core CPI excludes changes in food and energy prices, we all continue to buy food to eat and energy to power our cars and homes, regardless of higher prices, as they contribute to our overall cost of living. Average wages are higher year-over-year as well, but do not fully make up the changes in consumer prices for most Americans.

What we are starting to see is substitution behavior among consumers to combat the impact of inflation. Dealing with stretched household budgets, estimated to be $250 to $300 higher per month to purchase the same goods, can prompt the search for alternatives. Data from IRI, a consumer goods and retail analytics firm, shows that while the dollar value of the average shopping basket has increased over the past year, the number of items in the basket has declined. Choices can vary by consumer, but some may be reducing impulse item purchases such as flowers or snacks. Bulk purchasing can also increase during inflationary periods, as well as brand substitution to private-labeled goods, and shopping at more value-focused retailers.

As mentioned, wage increases can support some inflationary pressures. Employment growth can also support some inflation pressure as one-income households become two-income households. An increase in labor force participation, particularly as schools fully re-open post-COVID, can be supportive of household income.

________________________________________

Want a printable version of this report? Click here: NovaPoint February 14, 2022

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.