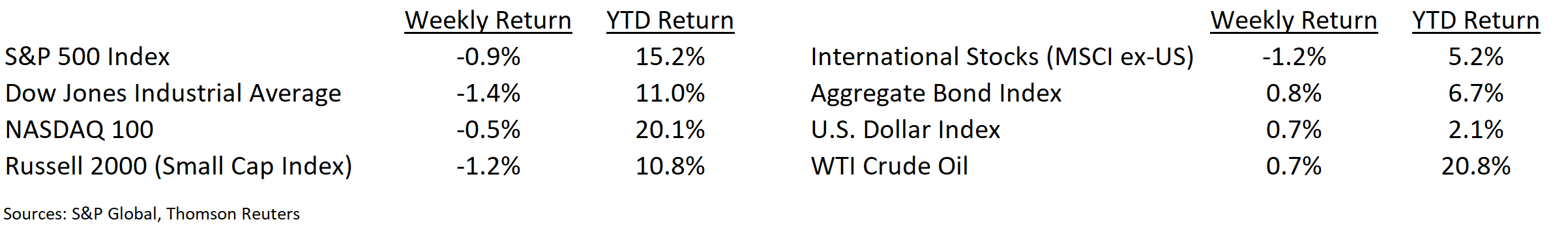

It was a volatile week in the stock and bond markets with each day providing a different catalyst to change market direction. The week started with continued concern over U.S. dollar / Chinese yuan exchange rate and trade/tariff issues. Optimism reigned on Tuesday as the White House announced a delay to some tariffs until December. Wednesday was the worse day of the year with the S&P 500 Index down 2.9% as a yield curve inversion between 2-year and 10-year interest rates stoked recession fears. This followed through early Thursday but the market closed higher on optimism partly sparked by Wal-Mart’s earnings and a reversal of the yield curve’s 2-year/10-year inversion. The market rallied on Friday as interest rates in the U.S. stabilized and investors anticipated global central bank stimulus could emerge to combat economic weakness.

On second quarter earnings, 463 companies in the S&P 500 have reported quarter-to-date. Seventy-three percent of companies have reported earnings above expectations, 18% below expectations, and 8% in-line. The current consensus expectations for the S&P 500 Index earnings growth for the second quarter increased to +2.9% from +2.8% the week prior and versus expectations for a 0.4% decline at the start of the earnings reporting season. The expectation for revenue growth for the quarter is 4.7%.

Headlines on economic and geopolitical events are likely to determine market direction for the next few weeks as the news flow from corporate earnings slows.

Disclosure: NovaPoint Capital owns Wal-Mart (WMT) in its Dividend Growth Strategy

Financial Market Update

Dissecting Headlines: Jackson Hole and Beyond

With the quarterly earnings season winding down, investors will likely take direction from macroeconomic and geopolitical headlines. This coming week the minutes of the July FOMC meeting will be released and the Fed Chairman Jerome Powell will be speaking at the Fed’s Annual Jackson Hole Policy Symposium.

Depending on the contents of the meeting minutes and the tenor of the Fed Chairman’s speech, market participants may re-evaluate their view of the potential for a reduction in the Fed Funds target rate at the September 18th Federal Open Market Committee meeting. Based on interest rate futures contracts, the market is currently pricing in a 78.8% chance that the FOMC reduces its Fed Funds target by 0.25% to a 1.75% – 2.00% range and a 21.2% chance that the FOMC reduces rates by 0.50% to a 1.50% – 1.75% range.

___________________________________________________________

Want a printable version of this report? Click here: NovaPoint August 19, 2019

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.