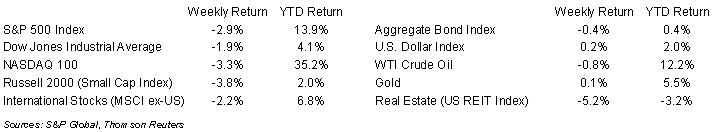

The Federal Reserve refrained from raising short-term interest rates last week, but revisions in the Summary of Economic Projections that pointed to a “higher for longer” scenario weighed on stocks. The weekly return for the S&P 500 Index was -2.9%, the Dow was -1.9%, and the NASDAQ was -3.3%. All eleven S&P sectors were negative for the week with the Consumer Discretionary and Real Estate sectors declining the most and the Health Care and Utility sectors declining the least. The 10-year U.S. Treasury note yield increased to 4.440% at Friday’s close versus 4.322% the previous week.

The Federal Open Market Committee (FOMC) left the current Fed funds target range at 5.25% to 5.50%. The committee also left the terminal range at 5.50% to 5.75% for 2023, indicating a potential 0.25% increase at either the November or December meetings. The higher for longer scenario was projected in the revision to the 2024 Fed funds target range, now at 5.00% to 5.25% versus 4.50% to 4.75% previously.

We head into this week with the potential for a short-term government shutdown on October 1st. The political parties are still debating terms on a spending bill for the upcoming fiscal year. There have been 14 shutdowns since 1981 with most lasting only a day or two. The situation should continue to unfold over the week.

In our Dissecting Headlines section, we review the economic projections that underpin current FOMC monetary policy.

Financial Market Update

Dissecting Headlines: FOMC Meeting Review

The FOMC left the Fed funds rate unchanged at a 5.25% to 5.50% target range, as expected. There were changes in the Summary of Economic Projections that pointed to better near-term economic performance and a “higher for longer” scenario for the Fed funds rate.

For 2023, the FOMC sees Gross Domestic Product (GDP) at 2.1% growth versus 1.0% previously and unemployment is seen at 3.8% versus 4.1%, indicating stronger economic growth and a stronger labor market than previous forecast. Inflation, as measured by Personal Consumption Expenditures (PCE) prices, is seen at +3.3% versus +3.2% previously. This is likely due to the recent increase in energy prices. Core PCE, which excludes the impact of food and energy prices, is now projected at +3.7% versus +3.9% previously, indicating the FOMC sees progress on the fight against core inflation.

For 2024, GDP growth is now seen at 1.5% versus 1.1% previously and unemployment is seen at 4.1% versus 4.5%, likely a carry over from the change to 2023 mentioned above. Inflation, as measured by 2024 PCE prices, is seen consistent with the previous estimate at 2.5% and core PCE is seen at 2.6%, also consistent with previous estimate. Core PCE prices at 2.0%, the Federal Reserve’s stated target, is seen as a 2026 event.

A lot can happen over the next 12 to 18 months, so economic projections are likely to be continuously revised and the Federal Reserve is likely to remain data dependent in its approach to appropriate monetary policy.

________________________________________

Want a printable version of this report? Click here: NovaPoint Weekly September 25, 2023

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.