The equity markets rebounded this past week to finish with their first weekly gain in five weeks. Optimism on international trade between the U.S. and China was the major catalyst for the weekly gain in stocks. With no significant corporate earnings news, we’ve stressed that economic and geopolitical news is likely to set market direction for the next few weeks.

U.S. and Chinese trade representatives held a brief meeting this past week and are scheduled to hold further talks in September. The market took comfort that China stated it was not planning to retaliate against the latest U.S. tariffs going into effect this week and it was willing to resolve the trade dispute through calm negotiations. Despite the scheduled meetings, additional tariffs go into effect this week. The U.S. is placing a 15% tariff on several categories of consumer goods from China, with some in effect September 1st and the remainder on December 15th. China is placing a 5% to 10% tariff on agricultural products, crude oil, and small aircraft from the U.S. on September 1st and a 5% to 25% tariff on automobiles and auto parts on December 15th.

The ISM Manufacturing and Non-Manufacturing Reports, the Fed’s Beige Book and the Employment Report will give investors plenty of economic data to examine in the holiday shortened week. This data will begin to shape investor expectations for what actions the FOMC will take at its September 18th meeting. Based on interest rate futures, there is a 97% expectation the FOMC will lower its target interest rate by 0.25% at the meeting to a 1.75% to 2.00% range and a 3% probability they leave the target rate at its current 2.00% to 2.25% range. We explain the components of the Employment Report below.

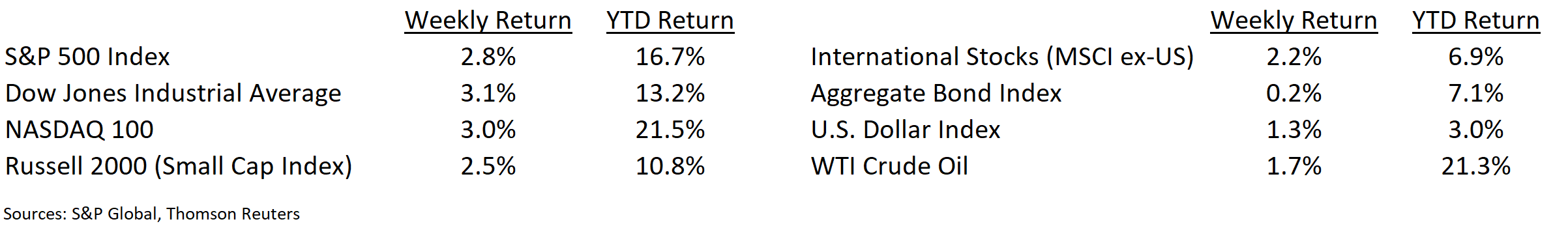

Financial Market Update

Dissecting Headlines: The Employment Report

One of the most watched monthly economic data points is the Employment Situation Summary issued by the Department of Labor. Also known as the Employment Report or Jobs Report, it provides two potentially market moving numbers, the current unemployment rate and the number of jobs created or lost.

The Household Survey measures the labor force status, including unemployment, and produces the unemployment rate which currently stands at 3.7% based on the July data. The Establishment Survey measures nonfarm employment, hours worked, and earnings. It provides the increase/decrease in nonfarm payroll employment. Farm employment is extremely seasonal, so it is excluded from the Establishment Survey.

The Employment Report is an important gauge of the health of the U.S. economy. One of the primary objectives of the Federal Reserve is maximizing employment, so the data from the Employment Report can have a significant impact on monetary policy.

The August Employment Report will be issued on Friday, September 6th.

___________________________________________________________

Want a printable version of this report? Click here: NovaPoint September 2, 2019

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.