Following the Federal Open Market Committee (FOMC) announcement to lower its target range for the Fed Funds Rate by 0.25%, Fed Chairman Jerome Powell stated that the move was a “midcycle adjustment to policy” and that future rate cuts were not a guarantee. Despite the Fed Chairman’s comments, the markets are currently forecasting an 85% chance that there is an additional rate cut at the September FOMC meeting. We think the Federal Reserve will continue to monitor economic conditions and act appropriately.

The White House also announced that it plans to place a 10% tariff on the remaining $300 billion of Chinese imports not already covered by existing tariffs. This came as a surprise as the two countries had agreed to resume trade talks following the G20 summit in June.

On the earnings front, 380 companies in the S&P 500 have reported quarter-to-date with 74% reporting earnings above expectations, 18% below expectations, and 8% in-line. The current consensus expectations for the S&P 500 Index earnings growth for the quarter increased to +2.7% from +0.5% the week prior and expectations for a 0.4% decline at the start of the earnings reporting season. The expectation for revenue growth increased week-to-week from +3.6% to +4.5%.

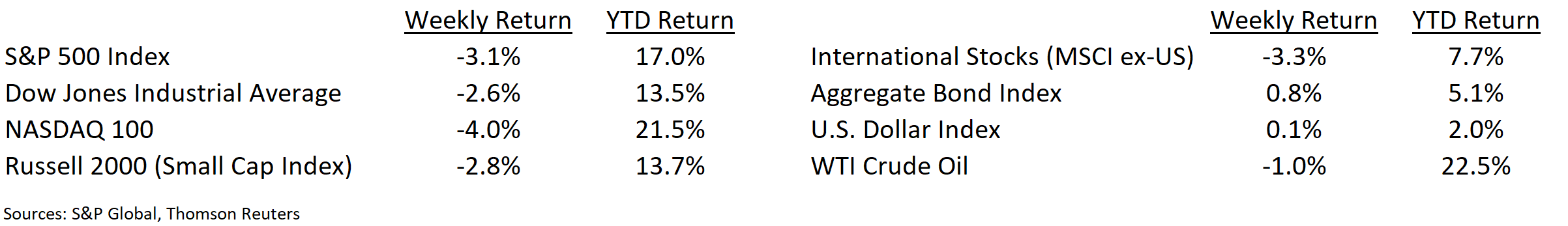

This combination of central bank, trade, and earnings news left the S&P 500 Index down 3.1% for the week.

Financial Market Update

Dissecting the Headlines: Institute for Supply Management (ISM)

The Institute for Supply Management (ISM) is a business organization of purchasing and supply chain professionals around the world. The ISM produces two highly watched monthly economic reports it creates from survey data of its members: The ISM Manufacturing Report which covers the manufacturing sector and the ISM Non-Manufacturing Report which covers the service sector.

The Manufacturing Report monitors changes in production levels, employment, new orders, deliveries, and inventories from month to month. A diffusion index is created from the data and an index reading above 50 indicates expansion of activity versus the previous month and a reading below 50 indicates contraction of activity. The Non-Manufacturing Report is similar and measures employment trends, prices, and new orders in the service sector.

The July ISM Manufacturing Report was released last week with a reading of 51.2 indicating continued expansion in the manufacturing sector. The Non-Manufacturing Report will be released this coming week and the forecast is for continued expansion in the service sector.

___________________________________________________________

Want a printable version of this report? Click here: NovaPoint August 5, 2019

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.