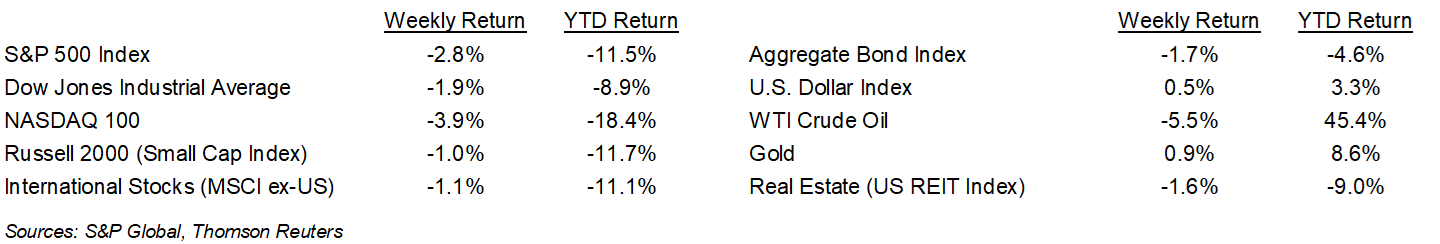

Geopolitical events continued to dominate headlines last week along with the economic realities of gasoline averaging over $4.00/gallon nationwide for the first time in history. The S&P 500 Index ended the week -2.8%, the Dow was -1.9%, and the NASDAQ was -3.9%. The 10-year U.S. Treasury bond yield increased to 1.997% at Friday’s close versus 1.738% the previous week.

The coming week should see the first in a series of Federal Reserve rate increases to begin a cycle of unwinding COVID-era monetary accommodation. Based on recent comments from Fed Chair Jerome Powell we anticipate a 0.25% increase in the Fed funds rate target on Wednesday. He has expressed a preference to approach the rate cycle gradually, especially given the economic uncertainty presented by the Russian-Ukraine war. We will also get a quarterly update on the Fed’s Summary of Economic Projections. The dot plot on expectations for the Fed funds rate can give us an indication of the pace of tightening for the year. We can also get some insight on the Fed’s outlook for GDP growth, unemployment, and inflation.

The last four companies in the S&P 500 Index report 4Q21 earnings this week. Earnings will likely end the 4Q reporting season with 32.0% earnings growth on 15.1% revenue growth. Looking forward, the current consensus for 1Q22 is 6.4% earnings growth on 10.7% revenue growth.

In our Dissecting Headlines section, we look at record setting fuel prices.

Financial Market Update

Dissecting Headlines: Fuel Prices

The increase in oil prices has flowed through to retail gasoline prices. For the week ending March 6th, Energy Information Agency (EIA) data reported the average price across the U.S. for regular gasoline was $4.102/gallon, a record. The input price of crude oil represents approximately 56% of the cost of a gallon of gasoline. Refining represents 14% of the cost, distribution and marketing is 16%, and taxes are 15%. The higher pump prices come at a time when most of the remaining work-from-home employees are returning to their offices, even if on a hybrid model. If the higher prices persist until Memorial Day, it could put a crimp on the travel plans of many Americans who are looking forward to a Summer break after two-years of COVID.

Diesel fuel prices have also increased sharply. National diesel fuel prices averaged $4.849/gallon for the week ending March 6th. This has a follow-on inflationary effect on virtually all goods being transported around the country. With the February Consumer Price Index showing a 7.9% year-over-year increase before the recent fuel price increases, we will likely see additional inflationary pressures on everything transported by rail and truck to absorb the higher cost of fuel across the supply chain.

________________________________________

Want a printable version of this report? Click here: NovaPoint March 14, 2022

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.